Pursuing a Master of Business Administration (MBA) at a top-tier U.S. university is a dream shared by many Indian engineers seeking to accelerate their careers, gain leadership roles, and increase their earning potential. However, obtaining an MBA—especially from the top 10 schools in the United States—requires a substantial financial commitment. This article aims to provide a step-by-step analysis of the return on investment (ROI) for a “typical Indian engineer,” along with all the assumptions made throughout the process.

Defining the scoping and top 10 U.S. MBA Programs

First, let us define the top 10 U.S. MBA programs. Different ranking organizations (e.g., US News, Financial Times, The Economist) produce slightly varying lists, but for our analysis, we will take the following as representative of the “top 10” (in no particular order):

- Harvard Business School (Harvard University)

- Stanford Graduate School of Business (Stanford University)

- The Wharton School (University of Pennsylvania)

- Sloan School of Management (MIT)

- Booth School of Business (University of Chicago)

- Kellogg School of Management (Northwestern University)

- Columbia Business School (Columbia University)

- Haas School of Business (University of California, Berkeley)

- Tuck School of Business (Dartmouth College)

- Yale School of Management (Yale University)

Although the exact tuition and living costs vary slightly across these schools, for simplicity, we will work with aggregated averages in the subsequent calculations.

Profiling the “Typical Indian Engineer” Pre-MBA Salary

To analyze ROI, we need a baseline candidate. Let’s define the key attributes of a “typical Indian engineer” who is considering a top U.S. MBA:

- Educational Background: Bachelor’s in Engineering (e.g., mechanical, electrical, computer science, etc.) from a reputable Indian institution.

- Work Experience: 4–5 years of experience in the technology sector, with a consistent track record of strong performance, possibly at an Indian IT company or a multinational technology firm.

- Pre-MBA Salary: An annual salary of around INR 10–15 lakhs (roughly USD 12,000–18,000 at an exchange rate of 1 USD = 80 INR), including bonuses.

- Post-MBA Career Goals: Transition into consulting, product management, tech leadership, or a strategy role in a multinational company in the United States—or potentially re-enter the Indian market at a senior level.

- Financing: Likely to depend on loans, personal savings, and possibly family support to fund MBA education.

By defining these attributes, we have a clear picture of the candidate for whom we are computing the ROI.

ASSUMPTION:

The candidate has a typical pre-MBA salary of USD 15,000 (INR 12 lakhs) per year and is aiming for a post-MBA salary in the U.S. that is standard for top MBA grads.

Are you planning to pursue MBA at top business schools? Let us help you conquer the first step of the process i.e., taking the GMAT. Take a free mock test to understand your baseline score and start your GMAT prep with our free trial. We are the most reviewed online GMAT Prep company with 2800+ reviews on GMATClub.

Cost Estimates (Tuition and Living Expenses)

Case 1 – No Scholarship

From the earlier analysis, the direct costs (tuition + living + miscellaneous) for two years were:

- Tuition: USD 160,000

- Living Expenses (2 years): USD 60,000

- Additional Costs (2 years): USD 12,000

Total Cost of Attendance (TCOA) = 160,000 + 60,000 + 12,000 = USD 232,000

Opportunity Cost

Foregone salary over two years (with 5% growth assumption):

Foregone Salary = USD 30,750

Internship Earnings (Offset)

Summer Internship: ~USD 35,000 (gross) earned between Year 1 and Year 2.

For simplicity, we’ll treat internship income as an offset to the total outlay. This effectively reduces your net cost because you are generating income while completing your MBA.

Internship Income = USD 35,000

Net Total Outlay

Net Outlay (50% scholarship + internship income)

= (TCOA + Foregone Salary) – Internship Income

= (152,000 + 30,750) − 35,000

= 182,750 − 35,000 =

= USD 147,750

Thus, with both a 50% scholarship and a paid internship, your effective total investment drops to USD 147,750, which is significantly lower than the no-scholarship scenario.

| Cost Component | Without Scholarship (USD) | With 50% Scholarship (USD) |

| Tuition | 160,000 | 80,000 |

| Living Expenses (2 years) | 60,000 | 60,000 |

| Additional Costs (2 years) | 12,000 | 12,000 |

| Total Cost of Attendance (TCOA) | 232,000 | 152,000 |

| Opportunity Cost (Foregone Salary) | 30,750 | 30,750 |

| Summer Internship Income | 35,000 | 35,000 |

| Net Total Investment | 227,750 | 147,750 |

| Total Savings with Scholarship | – | 80,000 |

Case 2 – With 50% Scholarship

Next, let us combine the 50% scholarship with the same internship assumptions.

Total Cost of Attendance (TCOA) With Scholarship

A 50% tuition scholarship reduces tuition from USD 160,000 to USD 80,000. Therefore:

- Net Tuition: USD 80,000

- Living Expenses (2 years): USD 60,000

- Additional Costs (2 years): USD 12,000

TCOA (with scholarship) = 80,000 + 60,000 + 12,000 = USD 152,000

Opportunity Cost

The opportunity cost of your foregone salary remains the same, USD 30,750, because you are still out of the workforce for two years.

Internship Earnings (Offset)

Same as above, you earn USD 35,000 over ~2.5 months during the summer.

Net Total Outlay

Net Outlay (50% scholarship + internship income)

= TCOA + Foregone Salary Internship Income

= (152,000 + 30,750) − 35,000

= 182,750 − 35,000

= USD 147,750

Thus, with both a 50% scholarship and a paid internship, your effective total investment drops to USD 147,750, which is significantly lower than the no-scholarship scenario.

Are you planning to pursue MBA at top business schools? Let us help you conquer the first step of the process i.e., taking the GMAT. Take a free mock test to understand your baseline score and start your GMAT prep with our free trial. We are the most reviewed online GMAT Prep company with 2800+ reviews on GMATClub.

Post-MBA Salary Projections

Starting Salary in the U.S.

Graduates from top 10 U.S. MBA programs typically command higher starting salaries. According to several MBA employment reports, the median base salary for fresh graduates often ranges from USD 140,000–165,000, plus signing bonuses and other benefits. For certain sectors (e.g., consulting, finance, tech), salaries can be even higher.

ASSUMPTION:

We use USD 150,000 as a baseline average starting salary (excluding sign-on bonuses) for our typical Indian engineer post-MBA, in a U.S.-based role.

Bonuses and Other Compensation

- Sign-on Bonus: Often in the range of USD 25,000 – 50,000.

- Performance Bonus: Could be 10–20% of the base salary, depending on the role and performance.

ASSUMPTION:

We keep it simple and assume a USD 30,000 sign-on bonus and an annual performance bonus of 10% (USD 15,000) for the first year.

So, for the first year post-MBA, total compensation might be:

Base Salary + Performance Bonus + Sign-on Bonus = 150,000 + 15,000 + 30,000 = USD 195,000

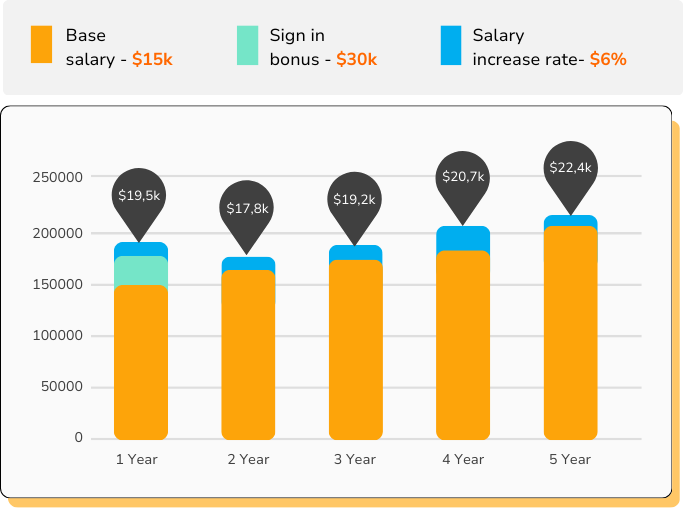

Annual Salary Growth Post-MBA

Let’s assume a relatively conservative annual salary hike of around 5–7% for subsequent years. Actual increments can vary widely based on performance, industry, and macroeconomic conditions.

ASSUMPTION:

We will use an average of 8% annual salary growth for the first 5 years post-MBA, excluding fluctuations in bonus structures.

ROI Calculation: Breakeven and 5-Year Projection

Year-by-Year Overview

We will do a simplified analysis over a 5-year horizon post-MBA, noting how long it might take to break even on the initial investment of ~USD 262,750.

- Year 0:

- Investment: USD 262,750 (including opportunity cost).

- Return: 0 (still studying).

- Year 1 Post-MBA:

- Salary + Bonus: ~USD 195,000 (from Section 5.2).

- Living expenses + taxes will reduce the net savings. However, for ROI calculations, we often use gross figures to compare overall cost vs. salary.

- Approximate saving potential depends on personal spending habits, taxes, and loan repayments.

- Year 2 Post-MBA:

- If the base salary grows 8%, the new base = USD 162,000.

- Performance bonus of 10% = USD 16,200.

- Total compensation (excluding sign-on bonus) = USD 178,200.

- Sign-on bonus does not recur (in most cases).

- Year 3 Onwards:

- Continuing a 8% increment. For simplicity, we won’t list every year but note the general pattern: the total compensation climbs steadily.

| Base salary | Sign in bonus | Performance bonus | Gross salary | |

| Year 1 | $150,000 | $30,000 | $15,000 | $195,000 |

| Year 2 | $162,000 | – | $16,200 | $178,200 |

| Year 3 | $174,960 | – | $17,496 | $192,456 |

| Year 4 | $188,957 | – | $18,896 | $207,852 |

| Year 5 | $204,073 | – | $20,407 | $224,481 |

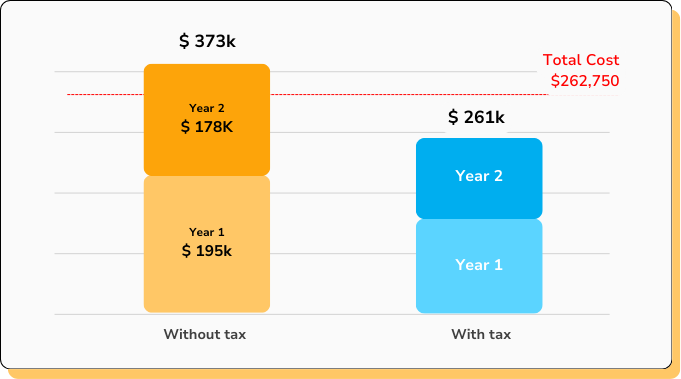

Simplified Payback Period

A payback period approach asks: When does total post-MBA earning surpass the total cost outlay? Because individuals have to pay taxes, loan interest, and living expenses, the actual net savings each year will be less than the gross salary. Nonetheless, to keep it straightforward:

- Total Cost: ~USD 262,750

- Year 1 Earning: ~USD 195,000 gross

- Year 2 Earning: ~USD 178,000 gross (no sign-on bonus)

By the end of Year 2, one might have accumulated USD 195,000 + 178,000 = USD 373,000 in gross earnings. If we discount for taxes (let’s assume an overall effective tax rate of 30% just to be illustrative) and living expenses, the “net payback period” often lands between 3 to 5 years, depending on personal finance management, interest on student loans, and individual circumstances.

Factors Affecting ROI

- Scholarships and Financial Aid: Any form of scholarship or fellowship significantly reduces the cost of attendance.

- Geographic Location Post-MBA: Working in high-paying cities like New York or San Francisco can accelerate payback but also comes with higher living costs.

- Industry and Role Choice: Consulting, finance, and technology often pay premium salaries to fresh MBA grads, helping offset loans faster.

- Economic Climate: The macroeconomic environment can affect hiring, salary increments, and overall career growth.

- Currency Exchange Fluctuations: If you plan to return to India after the MBA, changes in the USD/INR rate can significantly impact real ROI in INR terms.

Comprehensive Assumptions List

- Typical Pre-MBA Salary: ~USD 15,000 per year (INR 12 lakhs at 1 USD = 80 INR).

- MBA Tuition: ~USD 160,000 total for the two-year program.

- Living Expenses: ~USD 30,000 per year, totaling USD 60,000 for two years.

- Additional Costs: ~USD 12,000 over two years (health insurance, books, miscellaneous).

- Foregone Salary Growth: We assumed a 5% annual increment on the pre-MBA salary during the two-year period.

- Post-MBA Base Salary: ~USD 150,000 (median for top-tier MBA grads in the U.S.).

- Bonuses: ~USD 30,000 sign-on bonus + 10% annual performance bonus.

- Annual Salary Growth: ~8% for the first 5 years post-MBA.

- Tax Rate & Living Costs in the U.S.: For simplified ROI analysis, we used gross figures and an illustrative 30% effective tax rate for net pay considerations.

- No Scholarship/Financial Aid: We assumed the full cost of tuition and living expenses is borne by the student (self-funded or via loans).

Conclusion

An MBA from a top 10 U.S. university can be a transformative step for a typical Indian engineer, potentially leading to a substantial salary increase and significant career advancement opportunities. However, the cost of attendance—often exceeding USD 200,000—plus the opportunity cost of forgone salary, is a major financial commitment.

For many candidates, the breakeven point using gross salary figures can occur between 3 to 5 years post-graduation, assuming no major economic downturns or personal setbacks. Actual ROI varies widely depending on factors such as scholarships, industry choice, geographical location, loan interest rates, and personal financial habits.

Ultimately, while the financial investment is large, the long-term career prospects and earning potential typically justify the costs for those who leverage their MBA effectively. As with any major life decision, prospective students must conduct a thorough personal financial analysis—taking into account scholarships, personal savings, and career goals—before taking the leap.

Are you planning to pursue MBA at top business schools? Let us help you conquer the first step of the process i.e., taking the GMAT. Take a free mock test to understand your baseline score and start your GMAT prep with our free trial. We are the most reviewed online GMAT Prep company with 2800+ reviews on GMATClub.

Disclaimer:

All figures in this article are approximate and intended for illustrative purposes only. Actual tuition, living costs, and post-MBA salaries can vary based on personal situations, market conditions, and program-specific nuances. Readers are advised to perform detailed research and consult financial planners before making any significant educational investments.