Thousands of international students will attend a university in the United States for their MBA. After researching and preparing for the admissions process, many students will need to answer the next big question for successfully enrolling in an MBA program. How will I pay for my MBA in the US?

Some are lucky enough to have personal funds, company sponsorships, or scholarships to cover their cost of attendance or a portion of it. However, many international students are left looking for other sources of funding, especially as the cost of attendance can be quite substantial for the top business school MBA programs.

- Education loan for MBA

- Information regarding F1 Student Visa for MBA in US

- Ajay’s story of getting a loan for MBA

- Estimated the loan amount needed to meet his requirements

- Got in touch with Nomad Credit

- Understood the type of MBA loan options he is eligible for

- Understood if he qualifies for a US Cosigner loan option

- Received the MBA loan approval

- Obtained an approval letter from the lender to use to have his I-20 processed

- Appeared for the visa interview and received his F-1 visa

- Are you looking for a loan to finance your US MBA program?

Education loan for MBA

One such funding source that may be available to international MBA students is a student loan option. There are lenders in the United States and India that can lend to international MBA students. These options include those that may require a cosigner; however, no cosigner options do exist for eligible programs that may cover up to the full cost of attendance.

Also see – Information regarding F1 Student Visa for MBA in US

Ajay’s story of getting a loan for MBA

Ajay was such a student searching for a funding solution. He was looking at a significant shortfall of funds. This shortfall was the only thing coming in between him and his conformed admission offer from a US business school.

Here is how Ajay successfully received the loan amount and enrolled in his MBA program:

- Estimated the amount needed to meet his requirements

- Got in touch with Nomad Credit

- Understood the type of loan options he is eligible for

- Understood if he qualifies for a US Cosigner loan option

- Contacted the US cosigner with guidance from Nomad Credit

- Received the MBA loan approval

- Obtained an approval letter to have his I-20 processed

- Appeared for the visa interview and received his F-1 visa

Let’s understand in detail what he did for every step:

Estimated the loan amount needed to meet his requirements

Ajay was staring at a shortfall of approximately $120,000 that was needed for the upcoming academic year at a Top-10 ranked U.S. business school MBA program.

Not only that, but he also had an upcoming deadline to meet that required him to obtain funding quickly for him to enroll for the upcoming semester.

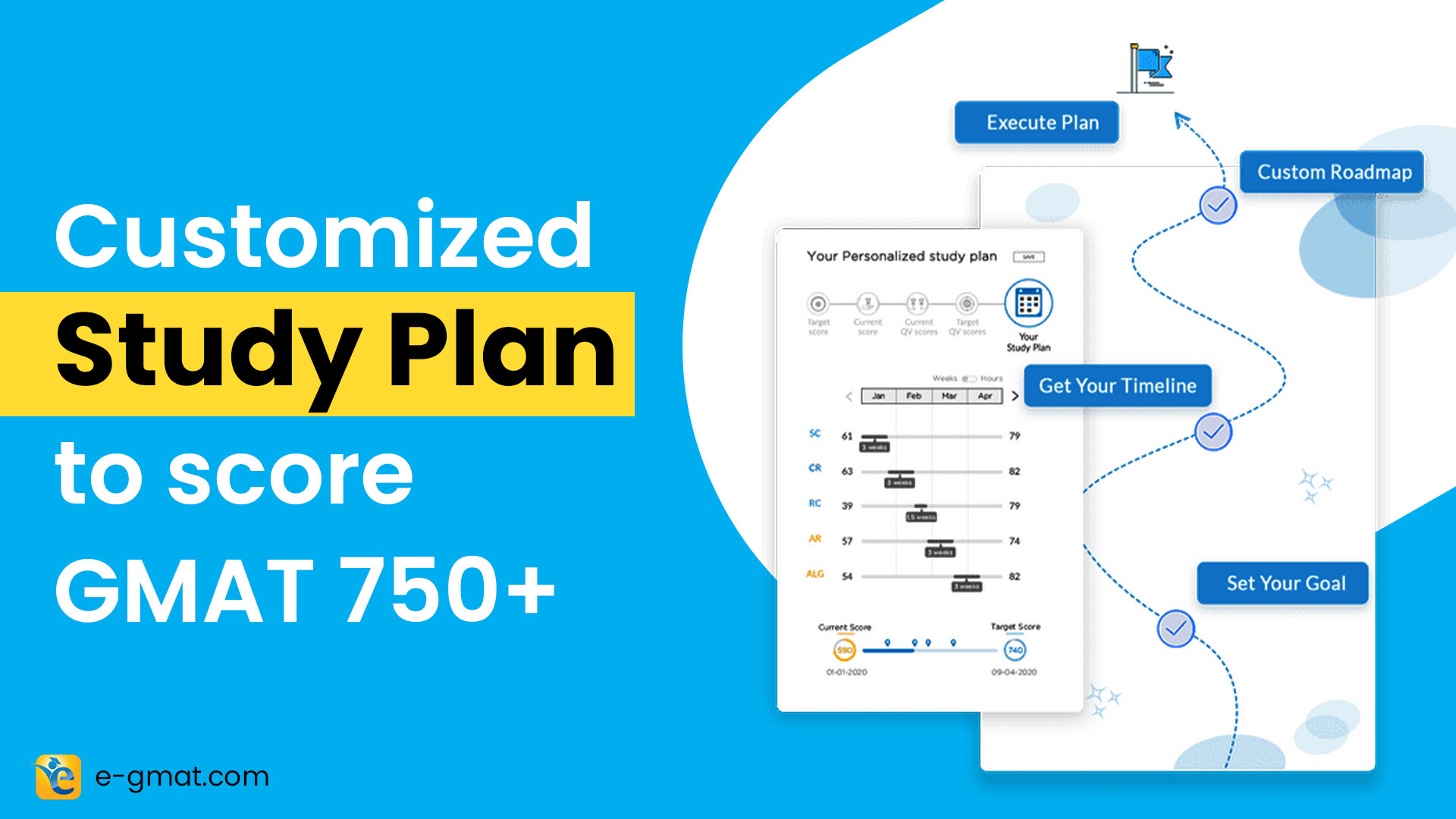

Did you know a GMAT score of 730+ yields incremental $500K in ROI? Start your GMAT Preparation by Signing up for our FREE Trial and get access to FREE online GMAT preparation resources. We are the most reviewed GMAT preparation company on GMATClub with more than 2400 reviews.

Got in touch with Nomad Credit

After hearing about Nomad Credit, Ajay came to them looking for help in finding a loan option that would be for the amount he needed and be processed quickly enough for his deadline.

Their resident loan option specialist scheduled a personal 1-on-1 consultation to learn precisely what his needs were and to explain to him his possible loan options based on his academic and financial profile.

Understood the type of MBA loan options he is eligible for

As they learned about Ajay’s MBA program and business school, they shared that he would be potentially eligible for multiple no cosigner student loan options from various lenders. Further, he could qualify for a U.S. cosigner loan option from lenders based in the U.S., if he had an eligible U.S. cosigner.

Ajay’s case was atypical as his first academic term started in the summer. Due to this reason, he would be unable to take a single loan option to cover the full upcoming year’s cost. Often, U.S. lenders are only able to lend within an academic year framework, which typically starts in the Fall semester and ends either in the Spring or Summer semester.

Thus, they explained to Ajay that he would need to apply for two loan options to cover approximately $120,000 – a loan option for the Summer 2019 academic period and a loan option for the Fall 2019 – Spring 2020 academic period.

Understood if he qualifies for a US Cosigner loan option

As Nomad Credit’s team spoke with Ajay further to learn his financial profile and cosigner capabilities, they learned that he had a close family friend who might be a potential U.S. cosigner.

Who is a potential US Cosigner for an education loan?

A potential cosigner is a creditworthy U.S. Citizen or permanent resident (green card holder), who is willing to cosign a loan option.

US Cosigner education loan for MBA

This development opened up the U.S. cosigner loan option, which typically can cover the full cost of attendance, usually does not have any processing fees or prepayment penalties, and generally can have lower interest rates than no cosigner loan options.

They spoke with the cosigner to answer any questions they had about the process and his responsibilities as a cosigner, and then he gave the go-ahead to cosign the loan option. Ajay decided to move forward with the application process for a U.S. cosigner loan option, as the no cosigner options either would not cover enough of the cost of attendance or likely be a higher interest rate than a U.S. cosigner loan option.

Received the MBA loan approval

Even though Ajay had to break his funding into two loan options and only needed approximately $45,000 for the Summer term (first loan), they explained to him that by applying for the full $120,000, if approved, it may allow him to show his university that he would have the full funding needed and confirm that his cosigner would likely be eligible for the full amount spread over two loan options.

Ajay applied and was successfully approved for the full $120,000 at a rate and repayment terms that he and his cosigner were happy with.

Obtained an approval letter from the lender to use to have his I-20 processed

Next, Nomad Credit explained how he could obtain an approval letter from the lender to use to have his I-20 processed. The school approved it as a source of funds, allowing him to proceed to the visa interview process.

Appeared for the visa interview and received his F-1 visa

As part of Nomad Credit’s service, they provided a visa interview consultation to help prepare him for the visa interview. They helped him be ready to answer any questions that may arise with having a U.S. loan option as proof of funds. The interview went off without a hitch, and he received his F-1 visa for his university.

From there, they helped Ajay finalize the loan option process. Receiving just approximately $45,000 for the summer 2019 academic period, he needed to apply again for the Fall 2019 – Spring 2020 academic period for the remaining approximately $75,000.

He successfully gained approval for the second academic period and enrolled in his top-ranked MBA program, his funding sorted with a loan amount and interest rate that he was happy with.

Did you know a GMAT score of 730+ yields incremental $500K in ROI? Start your GMAT Preparation by Signing up for our FREE Trial and get access to FREE online GMAT preparation resources. We are the most reviewed GMAT preparation company on GMATClub with more than 2400 reviews.

Are you looking for a loan to finance your US MBA program?

If you are looking for a loan option to pursue an MBA in the United States, here are a few things you should keep in mind:

- Understanding all of the potential loan options that may be available to you – there are lenders in the U.S. and India that can have vastly different interest rates, loan amounts, and cosigner requirements based on your university choice, program of study, and financial profile

- Choosing to apply to the potential eligible loan option that fits your funding needs

- Navigating the loan option process through potential loan approval, I-20 obtainment, visa approval, and enrollment

About the author

Nathan Treadwell is a U.S.-based executive at Nomad Credit, a marketplace for international student lending options, who leads the U.S.- based loan option team. He has overseen hundreds of international graduate students search for their student loan options for study in the U.S. For more information about Nomad Credit and your potential student loan options, please contact help@nomadcredit.com.